Ten things Canadian employers need to know about statutory holidays

Ted Kenney

*Updated November 28, 2017

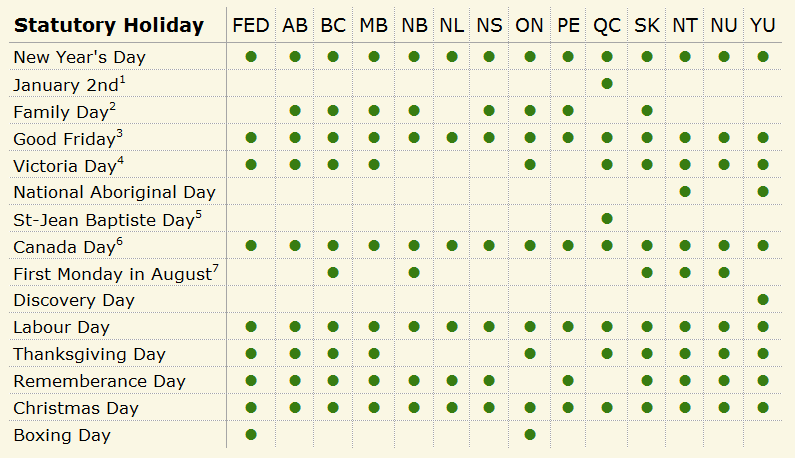

Statutory holidays, also known as public holidays and stat. holidays, are days designated by government to mark special occasions or events. In Canada, there are several statutory holidays. Some are national and every province and territory observes the public holiday; some are unique to a particular jurisdiction.

Typically, a statutory holiday means that workers are entitled to take the day off without losing pay. But this is a general entitlement, with several exceptions and qualifications, such as what happens when a stat. holiday falls on a weekend or other non-working day. The rules for public holidays—like how you calculate stat. holiday pay—also differ depending on your jurisdiction. I’ll outline these exceptions and some others below.

How many statutory holidays are there in Canada?

There are several statutory holidays across Canada under employment/labour standards. There are also holidays that are celebrated provincially or regionally, but are not statutory holidays. For example, Discovery Day is a paid holiday for government employees in Newfoundland and Labrador, but not a public holiday under employment standards. July 9 is Nunavut Day and is a paid holiday for government employees only.

The holidays that are actually observed as statutory holidays under employment/labour standards will vary depending on your jurisdiction, and include:

1. In Quebec, employees in the clothing industry (but not those who work in clothing stores) are entitled to also receive January 2 as a statutory holiday. Though not a legal requirement, it has become customary to give this day off to team members.

2. Known as Louis Riel Day in Manitoba, Heritage Day in Nova Scotia and Islander Day in Prince Edward Island.

3. In Quebec, employers may choose to observe either Good Friday or Easter Monday. Employees in the clothing industry (but not those who work in clothing stores) receive both.

4. Known as Patriots’ Day in Quebec

5. Known as Quebec’s National Day

6. Known as Memorial Day in NL

7. Several jurisdictions observe this day as a municipal holiday, not a statutory holiday (e.g., Ontario observes it as a municipal day called Civic holiday or Simcoe Day).

In addition, certain statutory holidays always take place on the same day of the month each year, regardless of the specific date. For example, Labour Day is always the first Monday of September. Others are recognized on specific numerical days of the month. For instance, Christmas Day and Boxing Day are always December 25 and 26, respectively.

Most employees who qualify are entitled to take these days off work and be paid public holiday pay.

10 key aspects of statutory holidays that employers need to know

These tips come from the First Reference compliance and best practice guide Statutory Holiday Rules across Canada:

-

What happens when a stat. holiday is on a weekend or other non-working day?

It depends on the jurisdiction. In some jurisdictions, an employee who works normally from Monday to Friday still receives a day off when the statutory holiday falls on a weekend. It is regular business practice to have the next business day (e.g., Monday) set as the public holiday.

In other jurisdictions, British Columbia for example, when a public (statutory) holiday falls on a non-working day, an eligible employee is entitled to an average day’s pay and the employer does not have to provide another day off.

-

Can employees and employers agree to substitute statutory holidays?

Not all provinces require that an employer provide a substitute holiday with pay or holiday pay in lieu. Alberta does not require either when a holiday falls on a day that is not normally a working day for an employee and the employee does not work on that day. In some provinces, a substitute holiday with pay must be provided if the holiday falls during the employee’s vacation. In Quebec, for example, even though a substitute holiday is not required for most holidays that fall on a non-working day, the employer and employee must agree on a substitute holiday if the public holiday occurs during the employee’s vacation.

In some cases, the day the holiday is legally celebrated will actually change when it is scheduled on a weekend. Under the federal Holidays Act, when July 1 is a Sunday, Canada Day is deemed to be celebrated on July 2 (i.e., the following Monday), meaning that employers do not need to determine whether they need to provide a substitute holiday.

Essentially, there is a complete transfer of all employment standards requirements from the statutory holiday to the substituted day. This requires employee consent with two specific exceptions, detailed in Statutory Holiday Rules across Canada.

-

How to calculate statutory holiday pay

How you calculate statutory holiday pay will depend on the jurisdiction in which the employee works, since stat. holidays are covered under the Canada Labour Code (for federally regulated employees) and provincial/territorial employment and labour standards laws.

For example in Ontario, “statutory holiday pay” refers to the total amount of regular wages earned and vacation pay payable to the employee in the four work weeks before the work week that contains the statutory holiday, divided by 20. But in Manitoba, statutory holiday pay must be at least the same amount as the employee’s wages for regular hours of work on a regular workday in the pay period in which the employee receives a day off for the holiday or, in which the holiday occurs, if the employee doesn’t receive a day off. If the employee’s wages vary, statutory holiday pay is calculated as five per cent of the employee’s gross wages in the four weeks right before the holiday.

-

When do overtime rules apply to a week with a public holiday?

Depending on the jurisdiction, statutory holidays may in fact make it more difficult for some employees to qualify for overtime calculated on a weekly or workweek basis. There are specific rules in each jurisdiction for when and how to calculate overtime pay during a pay period with a stat. holiday.

For example, in British Columbia, when the statutory holiday is not worked, the statutory holiday hours are excluded from the calculation of overtime. However, when the statutory holiday is worked, the hours worked are included in the calculation of overtime for that week. In federally regulated workplaces, the maximum hours required for overtime are decreased by one average working day of the employee and the statutory holiday is not included in overtime calculation.

-

Some employees are subject to special rules, while some are not entitled to public holidays

For example, in Ontario there are special rules for the calculation of holiday pay for employees who work in the production of women’s coats, dresses, sportswear and suits. The rules depend on whether such employees are paid by the piece or not.

Meanwhile, certain groups of employees do not receive stat. holidays because the law exempts the kind of work they perform, their profession or the industry or sector they work in.

-

Employees who are entitled to a public holiday must receive a day off work and public holiday pay for that day

Holiday pay is pay for days that an employee doesn’t have to work, because they are public holidays. How the employee is compensated for the day off varies by jurisdiction. Employees will receive general holiday pay depending on the method that they earn their wages.

For example, in Ontario, the calculation is (regular wages from 4 weeks previous + vacation pay from 4 weeks previous) / 20. You add up the last month of earnings and divide by 20 because there are 20 working days in a normal month. In federally regulated workplaces, for most employees, their holiday pay will be equal to at least one twentieth (1/20th) of the wages, excluding overtime pay that they earned in the four-week period immediately before the week in which the general holiday occurs.

-

Employees can be disqualified from receiving public holiday pay

However, this also depends on the jurisdiction. In certain jurisdiction, an employee must have worked for the employer for a certain number of days or months to qualify for public holiday. In federally regulated workplaces, for example, an employee must be employed for a minimum of 30 days in order to be eligible for holiday pay. In British Columbia, the employer must have worked or earned wages (including vacation pay) on at least 15 of the 30 days before the statutory holiday (unless under an averaging agreement or other variance in the 30-day period).

In some jurisdiction for instance, employees can be disqualified if, without reasonable cause, they fail to work their last regular scheduled day of work before the public holiday or their first regular scheduled day of work after the public holiday. This applies in Ontario and Manitoba for example.

-

Some employees may be required to work on public holidays

Employment/labour standards legislation does not prohibit work on a statutory holiday, but how employees are compensated for working on a statutory holiday varies between jurisdictions.

For example, in Nova Scotia, the employee would receive statutory holiday pay plus 1.5 times their regular rate for hours worked. In Prince Edward Island, the employee would receive statutory holiday pay, plus 1.5 times the regular rate for hours worked or regular wages, plus a day off with pay (with the equivalent number of hours worked), taken no later than the next vacation.

-

Some employers provide a greater right or benefit to employees

For example, some employers provide floater days, which are extra holidays that are treated as public holidays. This is viewed as providing a greater benefit and the agreement could supersede the legislation.

To determine whether you provide a greater right or benefit, you can review how many holidays you grant per year, the earnings on which holiday pay is calculated, the period of time over which earnings are averaged, how much time off in lieu employees receive for substituted holidays, and how much employees are paid for working on statutory holiday.

-

Does shift work impact statutory holiday pay?

Again, it depends on the jurisdiction. In Ontario, for instance, if the shift begins on a holiday, the entire shift—regardless of end time—is considered for holiday pay. If the shift begins on a non-holiday, no hours in the shift should be considered for holiday pay. In Nova Scotia, on the other hand, only hours worked on the holiday are considered as having been worked on the holiday, regardless of the start or end of the shift.

I hope you find this information helpful to manage public holidays at your workplace!

Feel free to leave a comment with any questions.

Get all the details plus a sample stat. holidays policy you can use right away in Statutory Holiday Rules across Canada, a First Reference Compliance and Best Practice Guide.

Purchase the guide here.

Table of Contents

Compliance Made Easy®